ACC levies set to increase

Introduction

This Topix looks at the proposed changes to levy rates for the three levied ACC accounts. There are small increases proposed for the Earners’ and Motor accounts and a reduction for the Work account. However, not all is what it seems…

Intro to ACC’s accounts

The ACC administers New Zealand’s no-fault accidental injury compensation scheme. The scheme provides financial compensation and support to all people who suffer personal injuries in New Zealand.

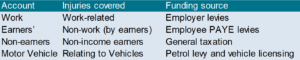

There are four main ACC accounts:

The motor vehicle levy is a fixed levy per vehicle and the earners’ levy is a fixed percentage of income (up to a limit).

The levies charged in respect of the Work account depend on the industry classification (and assessed risk) that the employees are assigned to. For example, the levy rate for construction workers will be different (and higher) than the levy rate for office workers.

The levies are determined by ACC on a regular basis. The most recent levy setting exercise has just completed its consultation period and the rates are due to take effect in the year beginning 1 April 2022.

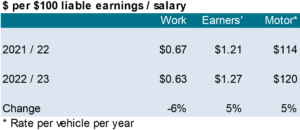

Proposed levy rates

The changes noted above do not appear to be particularly noteworthy and the Work account change is a decrease. Good news, right?

The problem is that these changes include the funding position / policy that have offset much of the true cost of funding claims. The proposed levy rates are determined on the following lines:

- Calculate the lifetime costs expected to arise from the coming year (the New Year Rate)

- Determine the current funding position surplus / deficit of the account (assets / liabilities) i.e. how much under/overfunding remains from prior years?

- Use any funding surplus or deficit to adjust levy rates to target a funding position of 100% over ten years.

- Limit any increases in levies to 5% per year

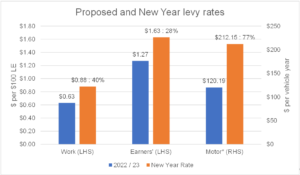

The chart below shows the proposed levy rate for the three accounts in the 2022/23 year with the New Year Rate (i.e. before application of caps and funding positions).

In all three accounts there is a significant gap between the proposed 2022/23 levy rate and the unadjusted New Year rates. This gap is currently being bridged by the funding position of each account and the limitation on levy increases being 5% per year.

There is therefore a projected long term increase in the levy rates for each of these accounts. In respect of the Earner’s and Motor Vehicle accounts there is little that the individual can do to mitigate these increases. However, for Employers with moderate to large workforces, there are a number of avenues available. More on this later. But first, why the projected increases?

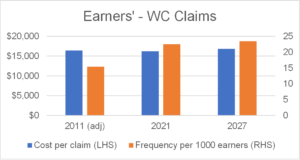

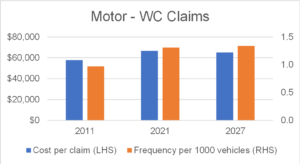

Claims experience

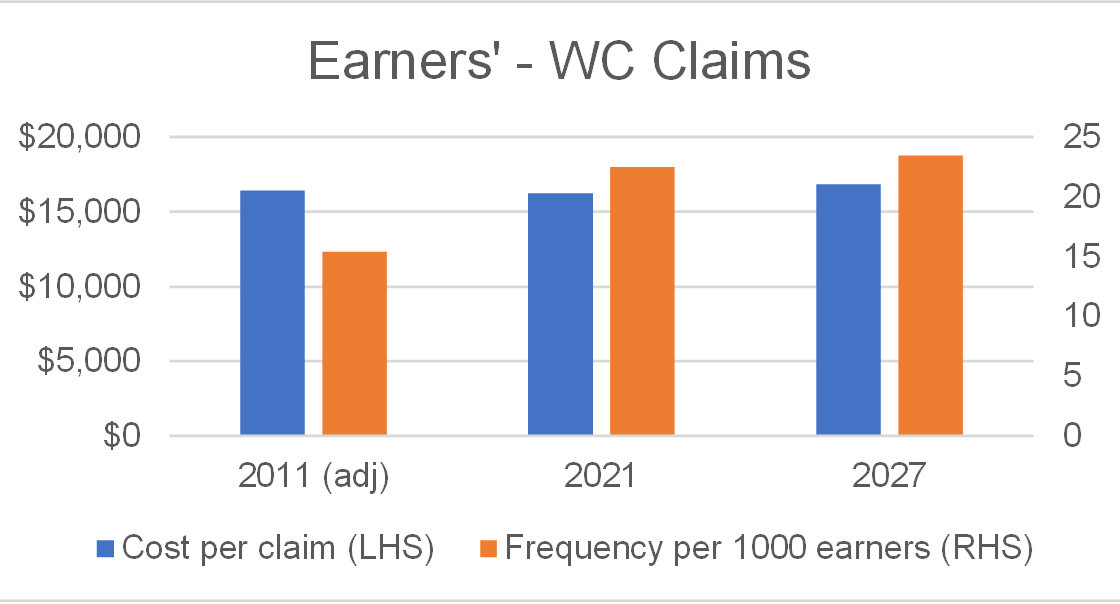

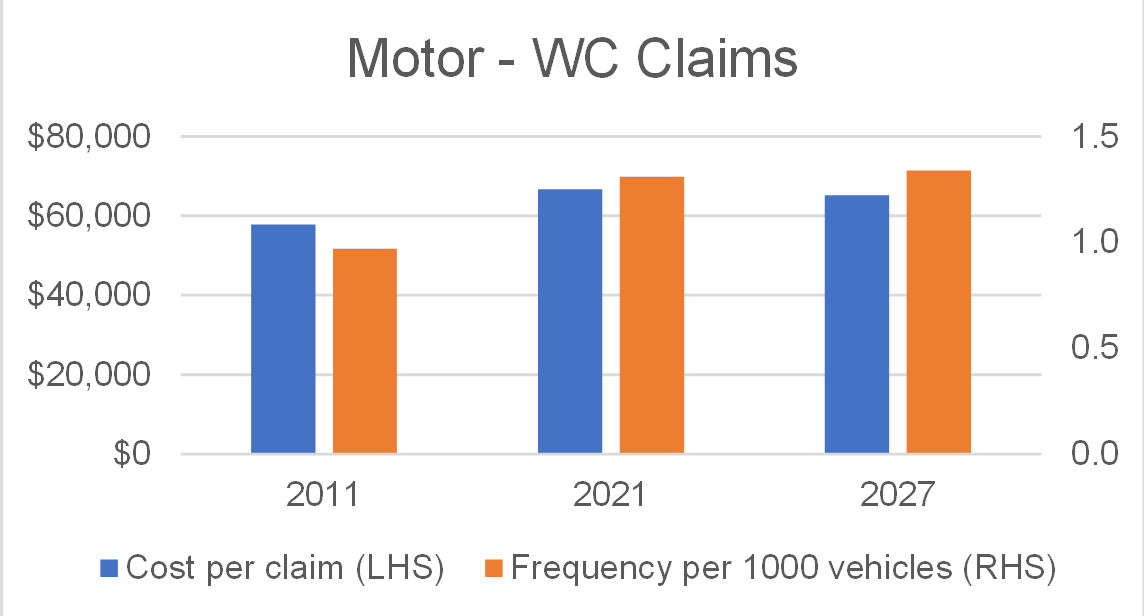

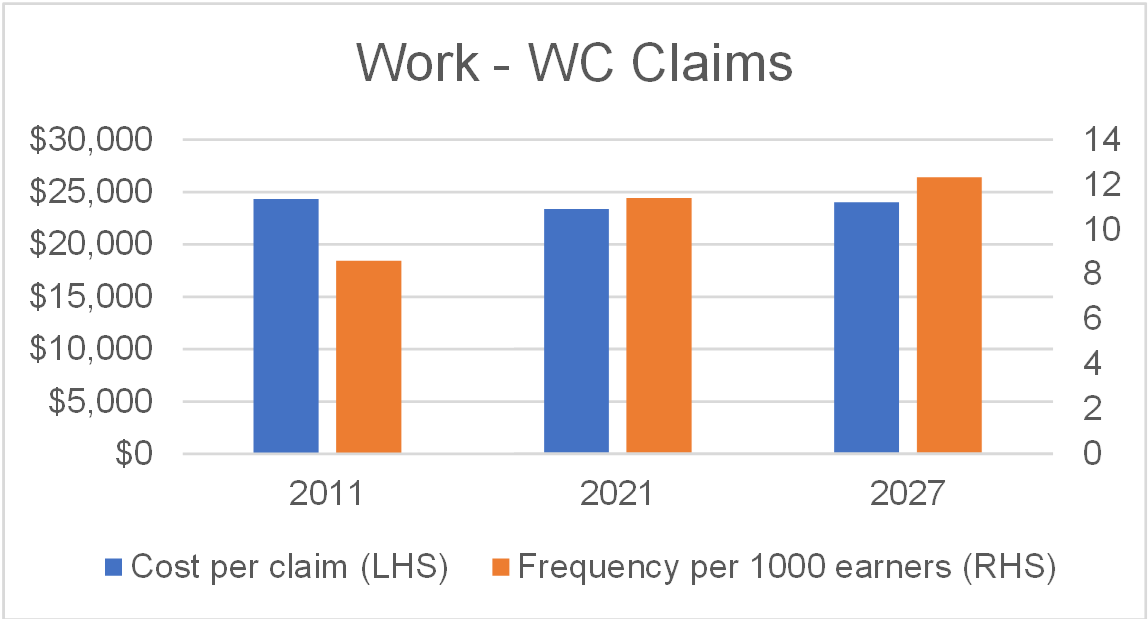

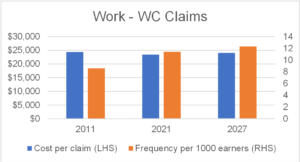

ACC’s performance across all accounts is deteriorating and has been for a while, caused primarily by the deteriorating experience of weekly compensation claims. These are the most significant type of ACC claim, potentially costing many hundreds of thousands of dollars. The following charts show the change in the severity and frequency of weekly compensation claims from 2011 to 2027 (projected). The 2011 cost figures have been adjusted for wage inflation.

In all three cases, there has been a large increase in the frequency of claims while the average cost has remained steady or slightly increasing. ACC has projected a stable move over the next six years but this will simply reflect ACC’s desire to halt the increasing costs. We will have to wait and see what actually occurs.

Actions to mitigate

Claims experience has been deteriorating and levies are projected to rise significantly over the medium term. What can be done by the individual or employer? In the case of the individual, levies are based on earnings and the number of motor vehicles owned / fuel consumed. While it is possible to reduce these two factors (earning less or owning fewer cars), this is probably not desirable. There is some benefit in owning an electric vehicle (paying no levies through fuel charges) although presumably ACC will need to consider how to incorporate these vehicles into its charging structure as the e-fleet grows.

Employers, on the other hand, do have some options available to them to mitigate ACC costs. That is, so long as you are not a small employer.

Standard levy experience rating

For employers with annual levies that are greater than $10,000, the standard levy may be adjusted based on the claims experience of the entity. The adjustment may be as much as -50% / +100% from 2022. That is, you may be able to halve the standard levy with sufficiently good claims experience but you could pay as much as double for poor experience. The experience rating factor depends upon:

- the duration of weekly compensation claims,

- the number of claims with medical costs over $500, and

- the number of fatal claims during the experience period.

There is therefore scope to affect these by reducing the frequency of accidents and by effective management of staff back to work after an accident occurs. The management of staff getting back to work can effectively be addressed via dedicated claims management (refer Accredited Employers Programme below).

Accredited Employers programme (AEP)

For large employers, there is the option of joining the AEP which allows the employer to pay a reduced levy for the responsibility of managing and bearing the financial responsibility of workplace accidents. There are two plans within the AEP:

- Partnership Discount Plan (PDP) – where the employer pays a reduced levy, manages and pays claims for a period of 1-2 years, and then passes responsibility to ACC.

- Full Self Cover Plan (FSCP) – where the employer pays an administration fee only, manages claims for a period of 4-5 years but is financial liable for the lifetime of all claims.

Under the AEP the employer bears the financial risk of its employees work related accidents which can be significant. However, many large employers are already members of the AEP (currently there are over 140 such employers, representing 23% of the workforce). There are many benefits, even for moderate sized employers, including:

Return to work: Studies have shown that return-to-work rates are superior for employers that manage their own claims. Thus, the employee returns to work more quickly than if managed by ACC. This leads to lower ACC claims costs, lower staff replacement costs and better work outcomes for the employee.

Experience rating: ACC applies discounts and penalties to the standard levy depending on the claims experience of the employer. The maximum penalty is 100% from April 2022 (up from 75% in the current year) which means that a poor year of claims experience could result in the employer paying 200% of the standard levy in the following year. An Accredited Employer is exempt from experience rating.

Insurance options – High Cost Claims Cover: Under the AEP employers may purchase HCCC to limit their exposure to single events to as low as $250k. A single event could result in one claim or multiple claims.

Insurance options – Stop Loss: Employers may also purchase Stop Loss insurance which will limit their total costs from a cover year to as low as 141% of the standard levy – considerably lower than the 200% worst outcome under the standard levy.

Financial risk exposure: Under the AEP, poor claim experience affects that year of cover only. Under the standard levy, bad events or bad years may contribute to penalties being applied for the following three-year period.

Summary

ACC’s recent claims experience has been worse than expected and this is projected to increase levy rates across its three main accounts. Under the Work account, moderate to large sized employers have the ability to try and mitigate these projected cost increases.

There are a number of non-financial reasons why this may be beneficial to the company including the ability to manage staff back to work and as a commitment to staff welfare.

Any employer considering this should seek qualified professional advice to ensure that this will be an appropriate solution.

Further information

If you want to find out more information about this note or how MJW can help you with your participation in the AEP, then please contact either of the authors below.

Authors

Download

This Topix is available as a PDF, click here to download a copy.

Want to know more?