Market commentary

As we write this, the direction of New Zealand’s response to Covid-19 appears to be changing. The elimination of the delta strain seems to be unachievable for the Auckland region, with case numbers steadily trending upwards since the end of September. It may only be a matter of time until the rest of New Zealand follows a similar trajectory. However, the vaccination uptake has been good, with two doses administered to 57% of the population (67% of the eligible population). The evidence is clear that vaccination materially reduces rates of hospitalisation and death, and therefore there is a growing light at the end of the tunnel. Many will be turning their gaze across the Tasman for clues as to what New Zealand’s eventual re-opening might look like.

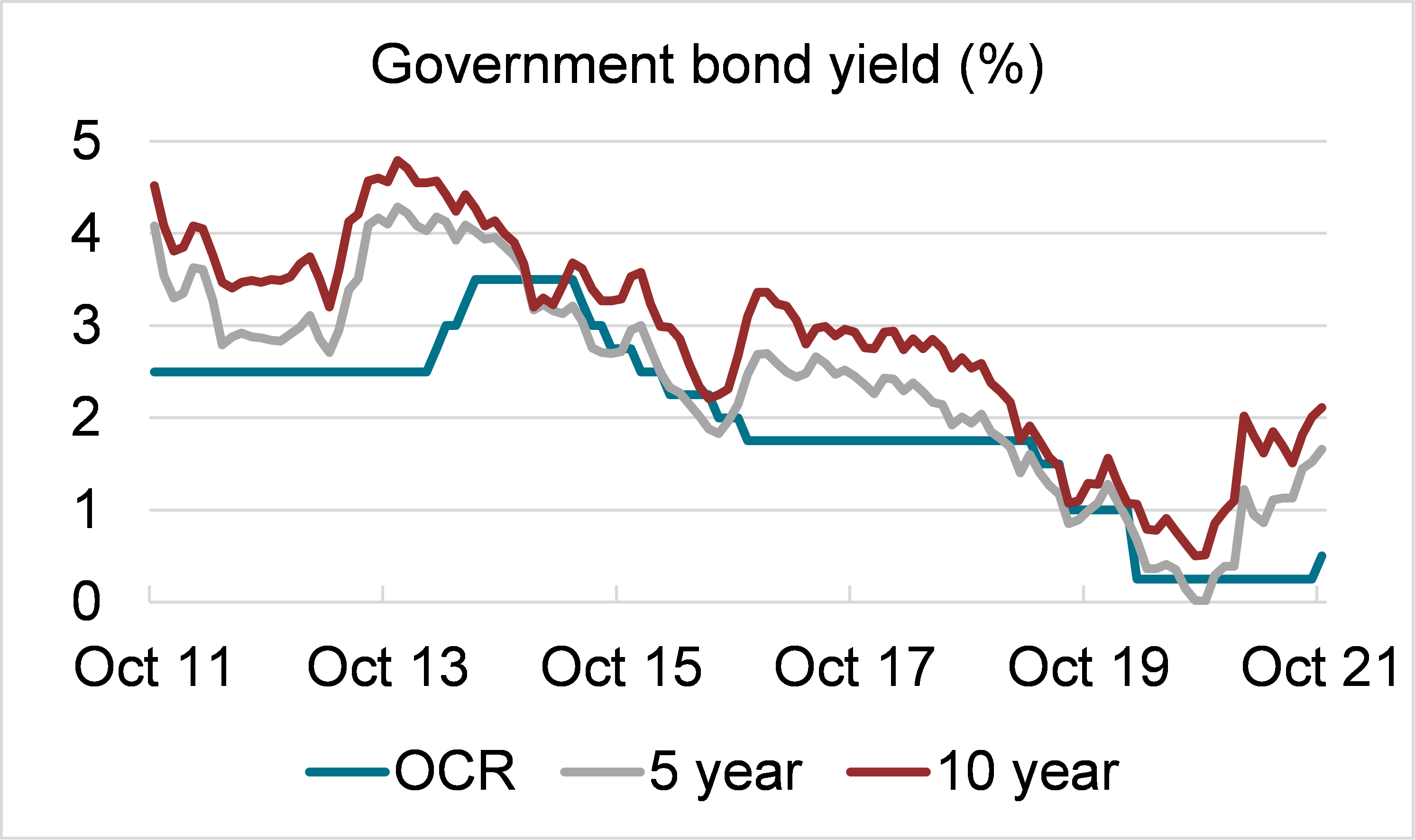

This latest lockdown is expected to hit Gross Domestic Product (perhaps to the tune of -7.0% in the September quarter), however the New Zealand economy has otherwise been strong. GDP increased 2.8% in the June quarter, smashing the Reserve Bank’s prediction of 0.7%. After backing away from its anticipated interest rate hike on the eve of the delta lockdown, the Bank raised the Official Cash Rate for the first time in seven years on 6 October. With prices rising 2.2% in the September quarter (4.9% for the twelve months), a pathway of “considered steps” upwards to an OCR of 1.5% to 2.0% looks likely over the next couple of years. Longer-term Government bond yields continue to trend upwards reflecting this.

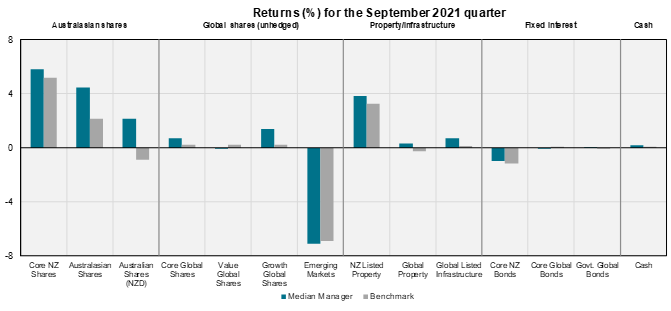

Following a tepid June quarter the New Zealand equity market accelerated in September, returning over 5% in the three months. Mainfreight and Ryman, which are among the largest constituents of the S&P/NZX 50 Index, were up 26% and 15% respectively. Z Energy also had a good quarter, up

25%.

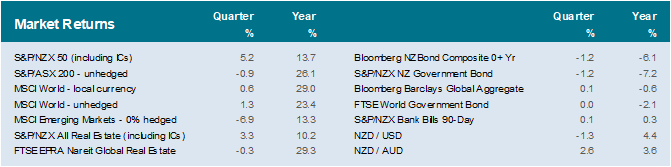

The local market was, therefore, well ahead of international equity markets which ended the quarter more or less where they began. Concerns over the US debt ceiling and accelerating inflation weighed on developed markets. Meanwhile emerging markets had a torrid quarter which began with the Chinese government’s crackdown on private education and technology companies, and ended with burgeoning concerns over Evergrande Group. These concerns particularly hurt Asian markets and those with exposure to materials. (The Australian share market was particularly weak due to its exposure to iron ore.)

Evergrande is China’s second largest property developer and has historically leveraged itself significantly. As a result of the Chinese government’s “three red lines” announcement in 2020 (limiting borrowing based on debt-to-cash, debt-to equity and debt-to-assets metrics), fears have been increasing over the company’s creditworthiness. Given its size, many fear a disorderly default could lead to a “Lehman Brothers moment” for global financial markets. So far, these fears have yet to materialise, although leverage across the world remains at high levels, portending a level of fragility.

Nevertheless, bulls are running rampant in various corners of the market. The number of initial public offerings (IPOs) in the first nine months of the calendar year is the highest since the dotcom bubble of 2000. More than 2,000 IPOs have raised US$421 billion in the year to date. This includes almost 500 special purpose acquisition companies (SPACs) which have together raised US$128 billion. SPACs are so-called “blank cheque” companies, since investors back (often well-known) portfolio managers to find and merge with a private company without knowing what the target is at the outset. The attraction to the target company is that it does not need to go through the same level of public disclosure as it would were it to list as an IPO itself.

Likewise, interest in cryptocurrency is again on the wax with our own Reserve Bank releasing a consultation on the “future of money” in September. The Bank is seeking input on areas such as digital currency at the same time as market interest in “crypto” is heating up again. Bitcoin recently passed US$62,000, doubling from its July level, albeit after halving from its all-time high reached in April. (Astute readers will note the flagship cryptocurrency is living up to its reputation for extreme volatility.)

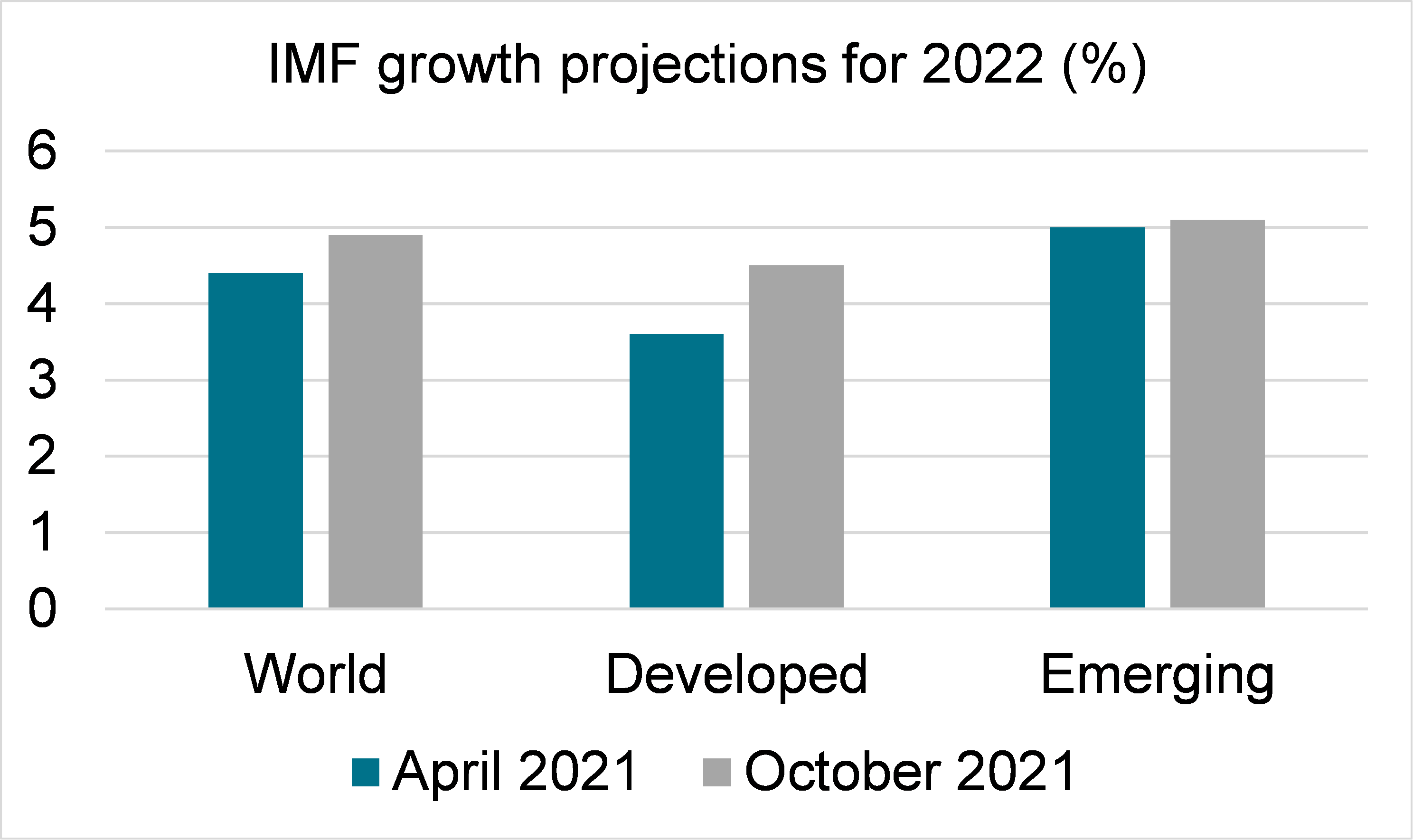

Optimism abounds then. The International Monetary Fund released its World Economic Outlook in October, and this dramatically revised up its prediction for global growth in 2022 from 4.4% (in its previous April report) to 4.9%. As shown in the following chart, this has almost entirely come from a brightening outlook for developed economies. (The US, in particular, is now forecast to grow 5.2% next year.) The outlook for emerging economies, while better, is little changed.

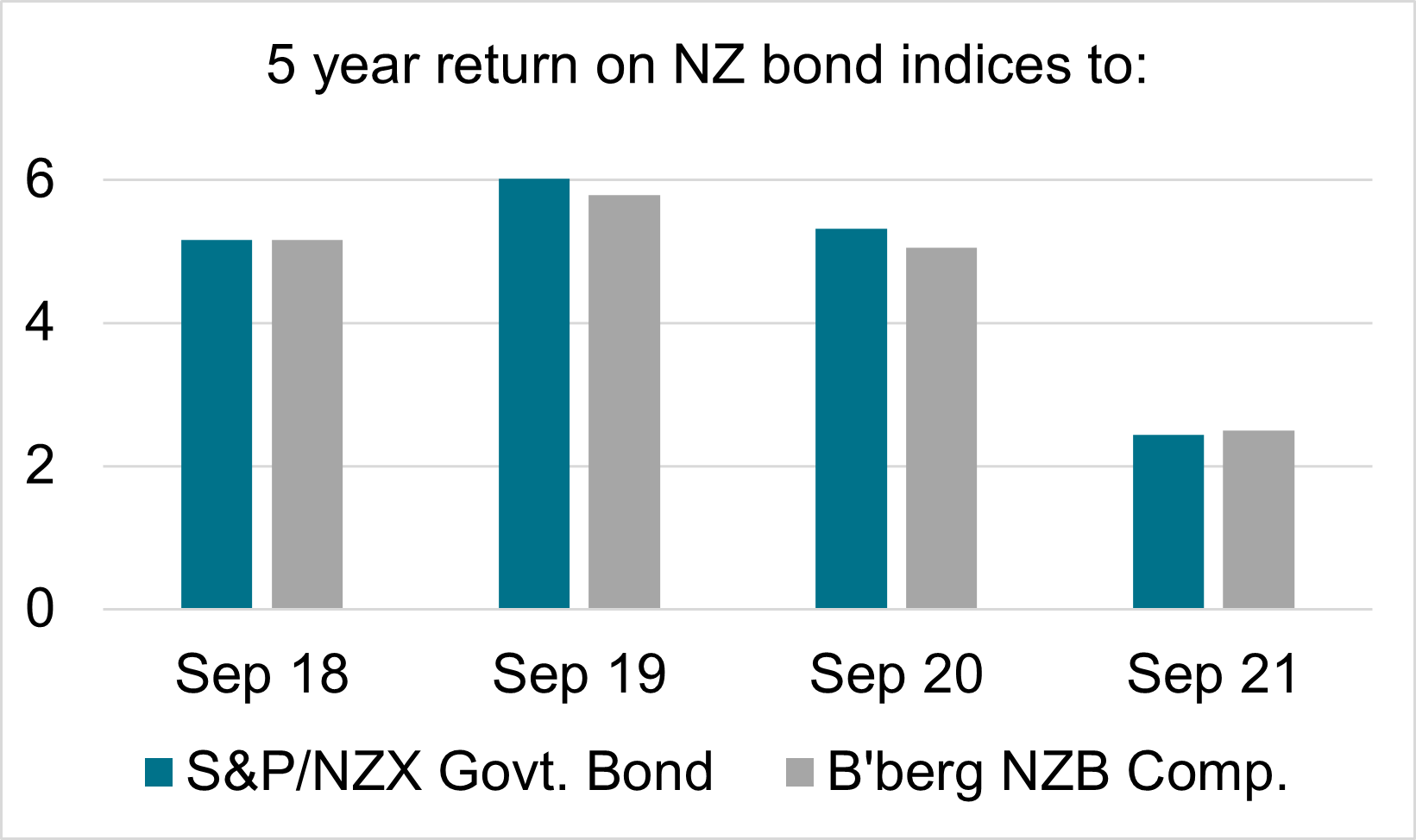

Turning to bond markets, September was another meagre quarter. New Zealand fixed income indices again posted negative results in the wake of rising interest rates. This brings the twelve month return for the S&P/NZX New Zealand Government Bond Index to -7.2%, while the broader Bloomberg NZBond Composite Index returned -6.1%, its fall softened due to its lower level of duration and higher running yield.

Longer term figures for bond market indices now look more in line with the running yields. In prior years, the long-term figures incorporated substantial mark-to-market gains; returns were high despite relatively low yields. With these mark-to-market gains reversing, the medium-term returns now reflect a more modest return profile from fixed income of 2-3% per annum.

Global bond investors are yet to feel the same level of pain. The Bloomberg Barclays Global Aggregate was about flat for the quarter, although it too is now showing a negative result for the trailing twelve months.

As at the time of writing, the yield on 10 year government bonds had risen to 2.4% in New Zealand and 1.7% in the United States. While still undeniably low, some prospects for positive returns are returning to bond portfolios – especially after allowing for credit exposure and active management.

Therefore, we are left with an ebullient equity market and a dour fixed income market. It will be interesting to see whether this sentiment continues to dominate in coming months. However, it is at times like these that Warren Buffett’s quote comes to mind: “Be fearful when others are greedy, and greedy when others are fearful.”

KiwiSaver

This month we released our in-depth review of the KiwiSaver market. With a massive shakeup in default providers under way, this report examines the health of the industry in detail, delving into assets, membership, and fees.

While KiwiSaver remains dominated by several large providers, some smaller providers have shown that they are able to carve out success stories by focussing on particular niches, be it socially responsible investing, lower fees, member engagement/advice, or strong investment performance.

Our report uses market share metrics to examine the competitiveness of the KiwiSaver market. We find little evidence for an overly concentrated market; indeed, current trends point to a more diverse and competitive landscape within KiwiSaver in the near future.

The full paper KiwiSaver Market Review paper is available here.

Download

This Investment Survey is available as a PDF, click here to download a copy.

Join our mailing list

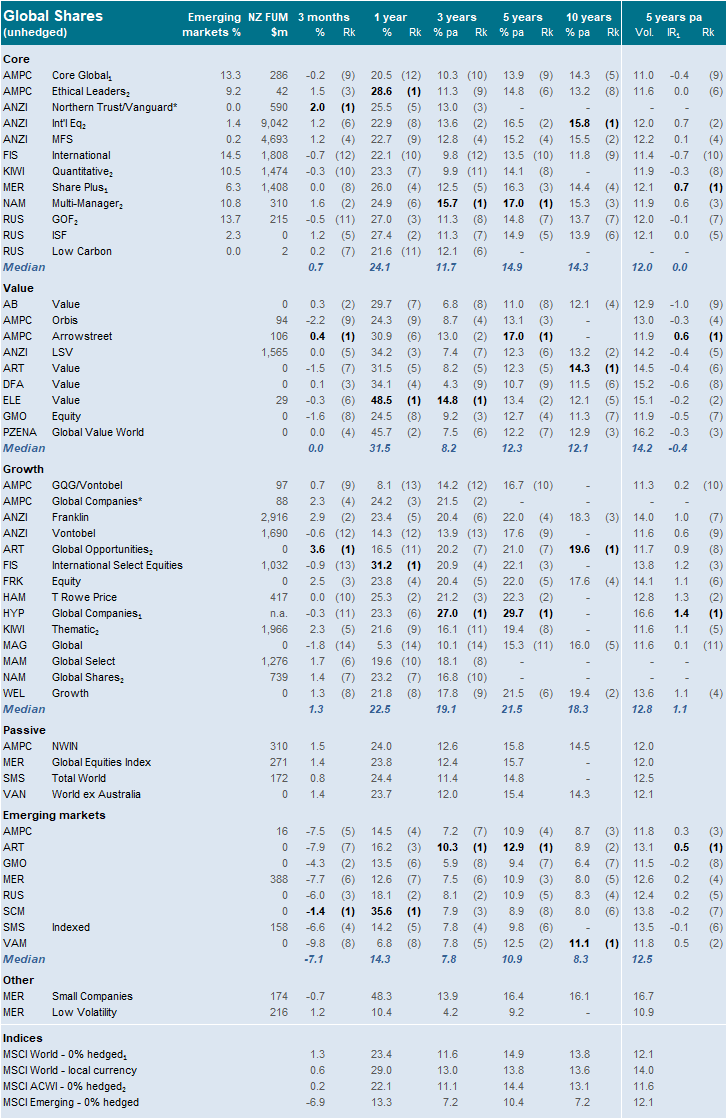

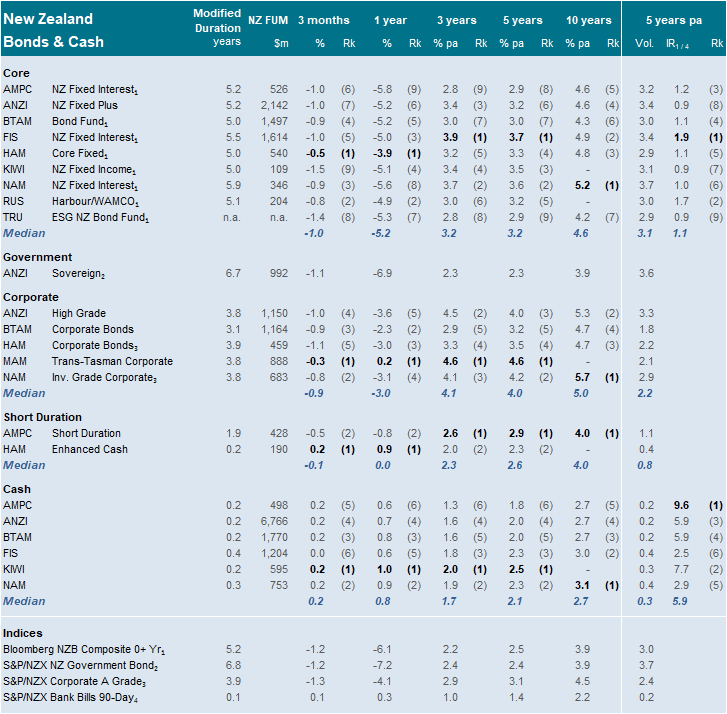

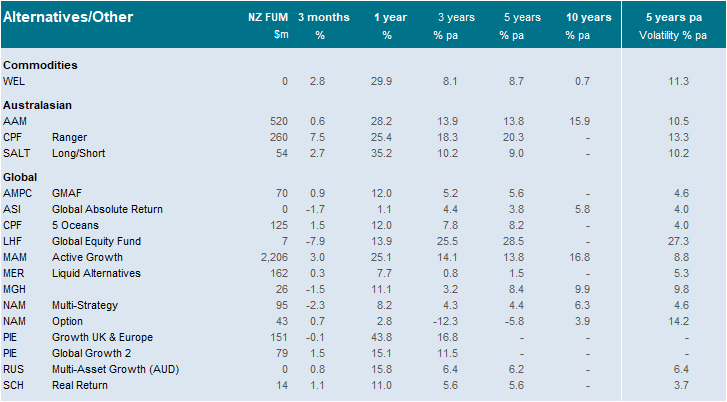

Wholesale Fund Returns (before fees and tax)

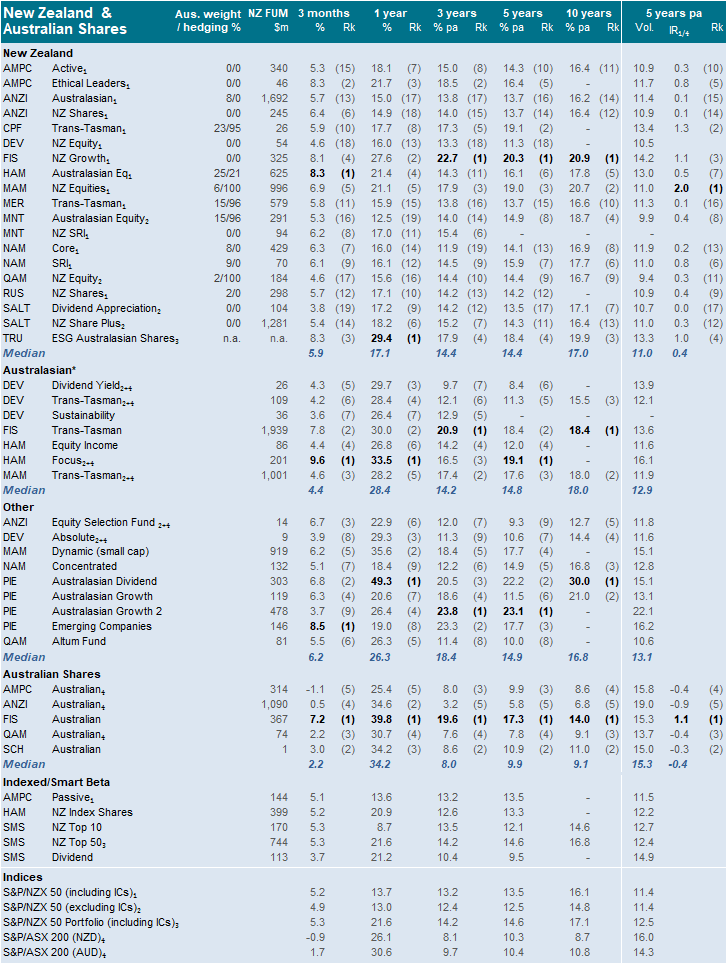

New Zealand & Australian Shares

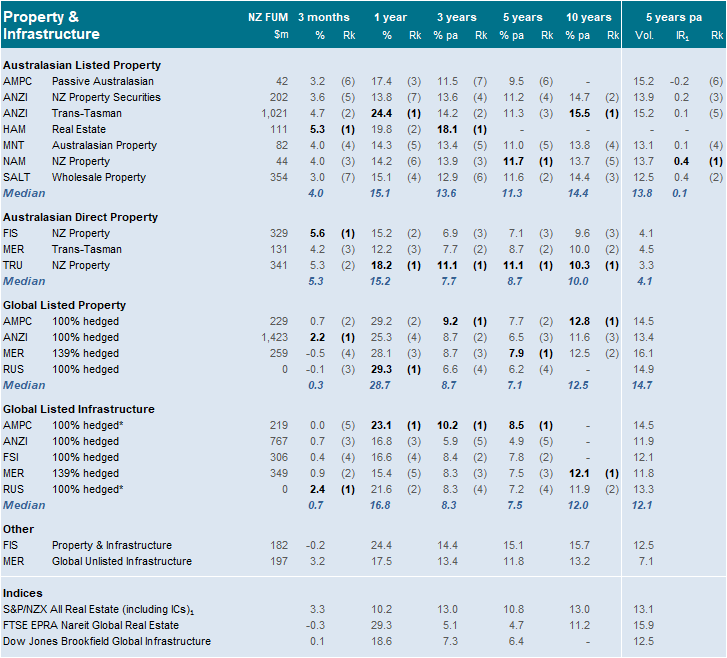

Property & Infrastructure

Global shares

New Zealand bonds and cash

Global bonds

Other

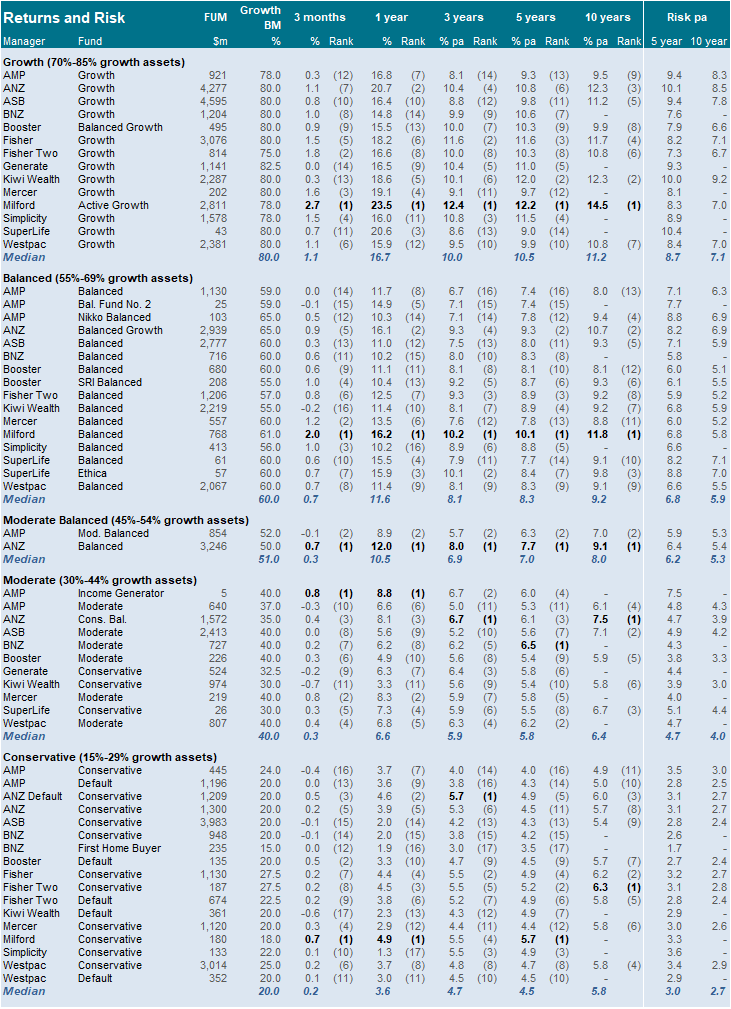

KiwiSaver

Return and risk

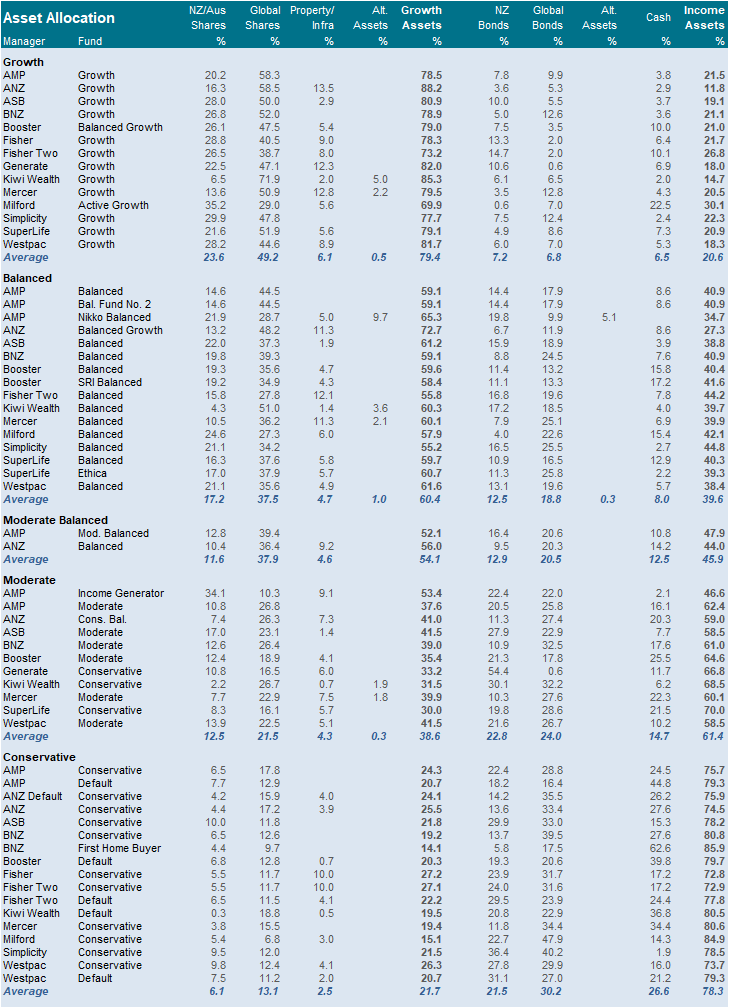

Asset allocation